A lot of people do believe that the surgical procedures, plastic surgery has been taken as one of the most instant way taken by most Hollywood celebs. However, this was rather incorrect and, presumably, no longer true in as much as Jeanine Pirro plastic surgery has shown that anyone can keep their gorgeous look by cosmetic treatment and control. Most people will agree that Jeanine Pirro is not a big star in the Hollywood industry. In fact, she is just a good prosecutor and judge. It will be undebatable that she has a gorgeous look after she had plastic surgery. Jeanine Pirro once was reported to have different surgeries ranging from face lid, botox treatment, and many more. Of course, you cannot imagine that she is truly sixty years old and, contrastingly, looks like a thirty-three-year-old woman. This for sure makes the rumors about her taking plastic surgery even surprising. Of the most shocking news is that Jeanine Pirro is so popular for her smooth legs.

What she has gained from the surgical procedures

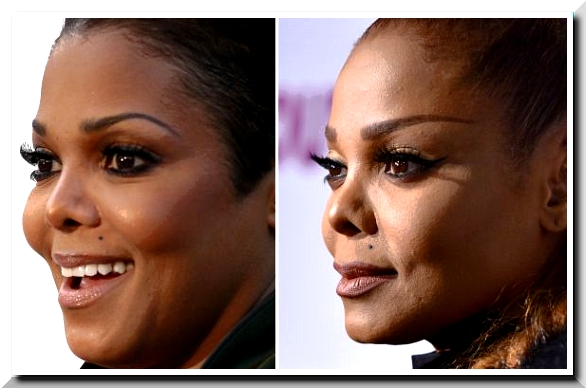

Jeanine Pirro became so popular by her fascinating appearance in a show named Judge Jeanine Pirro. She, additionally, got an Emmy award. Most people say that the Jeanine Pirro plastic surgery was a rumor. However, the professional surgeon claimed that the artists had used plastic surgery to boost her look. There are lots of differences that you can see. Jeanine Pirro was reported to have some botox treatment in order to make her skin tight and sexy. Her skin, particularly on the forehead is getting tighter after the use of botox injection that she took. There was no line at all that you can see on her face. She constitutes a pretty lady that makes use of plastic surgery. Most celebrities use botox injection to cope with the sign of aging. It has been widely known that botox injection is one of many cosmetic treatments that can bring about lots of significant change, something that everyone surely fancies. Each person can make use of Botox treatment to keep their skin tight and young. Jeanine Pirro plastic surgery once again affirmed that not only the wealthy and famous Hollywood superstars that can use plastic surgery to foster their youthful look. She does indeed look younger than her age. Most professionals in the surgery enterprise notice that there is not any wrinkle on her face and there is no line on her face. All of this news altogether made the news about Jeanine Plastic surgery even more convincing and sound true.

Was it more than a facelift?

Due to the rumor Jeanine Plastic surgery via evercorem.com, it was reported to have eyelid treatment that caused her to look much more attractive. After having done the surgical work, Jeanine Pirro once looked even charming with her bright eyes. It was due to the rumored work which was done enlarge a small part of the size of the cheek and lip. Before the surgery, her lip was rather thick and voluminous. However, after she had the surgical procedures, the artists looked so young in as much as her lips looked smaller and nicer than before. In addition, there was also nicety in the chin which can be noticed easily. Her chin was also different.

On the whole, Jeanine Pirro indeed did look better than she was used to. Again, it affirmed the rumor that she had taken some plastic surgery to boost her look. This also corroborated that plastic surgery did not necessarily tie to famous Hollywood superstars.